The Dream Begins

Sarah Johnson stood in front of a pretty white house with blue shutters. Her eyes sparkled with hope. "This could be our home, Tommy," she said to her 8-year-old son, who bounced excitedly on the sidewalk.

The year was 2003, and like many Americans, Sarah dreamed of owning a home. She worked hard as a nurse and saved every penny she could. But houses were getting more expensive every day.

A Time of Big Dreams

"You know what's great about America right now?" Mr. Rodriguez, the friendly real estate agent, said with a bright smile. "Banks are making it easier than ever for people to buy homes!"

Sarah wasn't sure what that meant, but it sounded good. More and more of her friends were buying houses too. Some didn't even have much money saved up!

Making it Easy

The banks had special new loans called "subprime mortgages." These loans helped people who didn't have perfect credit scores buy houses. It was like getting a giant piggy bank from the bank!

"Look at these payment options," Mr. Rodriguez showed Sarah some papers. "You can start with very small monthly payments. They'll get bigger later, but by then, your house will be worth more!"

Tommy ran around the front yard, already planning where he'd put his treehouse. Sarah smiled, watching him. Maybe they really could afford this house!

A Growing Trend

All across America, families just like Sarah's were buying homes:

• The Patel family down the street

• The Smiths next door

• The Garcias across town

• Even Sarah's cousin who worked part-time

“Everyone deserves a chance to own a home,” the bank manager told Sarah. “We’re here to help make that dream come true.”

Signs of Change

But some things seemed strange. Houses were getting more expensive really fast. Some people Sarah knew were buying bigger houses than she thought they could afford.

Her friend Maria warned her to be careful. "These new loans seem too good to be true," Maria said. "What happens when the payments get bigger?"

Sarah looked at Tommy playing in what could be their future yard. She wanted this so badly. The American Dream was right there, just waiting for her to grab it.

That evening, Sarah sat at her kitchen table, looking at mortgage papers. The numbers seemed to dance before her eyes. The dream of owning a home was so close she could almost touch it.

She picked up her pen, ready to sign. After all, everyone else was doing it. What could go wrong?

Little did Sarah know, she was about to become part of one of the biggest financial stories in history. The American Dream was changing, and not everyone would get their happy ending.

Tommy peeked over her shoulder. "Are we getting the house, Mom?"

Sarah smiled and hugged him close. "Maybe, sweetie. Maybe."

The Banking Game

Inside the shiny glass towers of Wall Street, Mr. James Parker sat at his big desk. He was a banker who helped create new types of loans. Today, he was very excited about something called “subprime mortgages.”

A New Way to Make Money

“Look at these numbers!” Mr. Parker told his team. “We can make so much money by giving loans to people who couldn’t get them before!”

The banks were playing a new game. Instead of just giving loans to people with lots of money saved up, they started giving them to almost anyone who asked.

The Magic Money Machine

But here’s where things got tricky. The banks didn’t keep these loans in their own piggy banks. They did something clever – or so they thought.

“We take all these loans,” explained Lisa Chen, a young banker, “and mix them together like ingredients in a cake. Then we sell pieces of this cake to other banks and investors!”

“It’s like magic!” said Mr. Parker. “We give out loans, then sell them to someone else. Then we can give out even more loans!”

Playing with Fire

Some people started to worry. Maria Rodriguez, who worked at a small bank, noticed something strange:

• People getting loans without good jobs

• Houses being sold for too much money

• Monthly payments that would get much bigger later

• Banks not checking if people could really afford their loans

The Money Train

“Why check if people can pay back their loans?” laughed Tony, a loan officer. “We’re selling these loans anyway. It’s not our problem!”

The banks were like kids trading baseball cards. Everyone wanted to be part of the game. They made up fancy names for these trades, like “CDOs” and “mortgage-backed securities.”

A Growing Storm

Maria tried to warn her boss. “We’re giving too many risky loans. What happens if people can’t pay?”

But nobody wanted to listen. The banks were making too much money. They were like children at a candy store, grabbing everything they could.

The Party Continues

Back in his office, Mr. Parker looked at his computer screen. The numbers kept getting bigger. More loans, more money, more houses being sold.

“This is the future of banking!” he declared proudly. “Nothing can go wrong!”

But outside his window, dark clouds were gathering. The banking game was getting bigger and more dangerous every day. And soon, everyone would learn that playing with money could be a very risky game indeed.

As the sun set over Wall Street, thousands of families across America were signing new mortgage papers, not knowing they were all part of a giant game that was about to go very, very wrong…

The House of Cards

Sarah Martinez walked through the quiet halls of her rating agency. She had a big job – looking at all those mixed-up mortgage loans and giving them grades. But something didn’t feel right.

A Scary Discovery

“These loans are like a tower of blocks,” Sarah told her friend Tom. “If one falls, they might all fall down!”

Playing Pretend

The banks were playing a tricky game. They took bad loans and made them look good. It was like putting a pretty wrapper on a rotten candy.

“But how can we give these risky loans such good grades?” Sarah asked her boss.

“Everyone else is doing it,” he replied. “If we don’t, the banks will go to someone else.”

The Big Mix-Up

Banks all over the world were buying these mixed-up loans. They were like kids trading stickers, but with houses instead!

Mr. Chen, a banker in China, called his friend in New York: “We want to buy more of these American house loans. They’re making us lots of money!”

The Wobbling Tower

Tom looked at his computer screen with worry. “The house prices can’t keep going up forever,” he said. “What happens when they start going down?”

The Hidden Problem

Nobody knew exactly who owned which loans anymore. The banks had mixed them up so many times! It was like a giant puzzle where all the pieces got scrambled.

Maria Rodriguez, the worried banker from before, wrote in her diary: “It feels like everyone is playing musical chairs. What happens when the music stops?”

The First Cracks

One day, Sarah noticed something scary. More people were having trouble with their house payments. The tower was starting to shake!

A World Connected

The problem wasn’t just in America anymore. Banks all over the world had bought these mixed-up loans. They were all connected, like a giant spider web.

Mr. Chen called New York again: “Are you sure these loans are safe? We’re starting to worry…”

The Quiet Before the Storm

Back in her office, Sarah looked at the stack of papers on her desk. She knew something big was about to happen. The house of cards was starting to shake.

“We all thought we were so clever,” she whispered. “But we forgot the most important thing – houses are homes, not just numbers on a page.”

As the sun set over the city, millions of people around the world went to sleep in their homes. None of them knew that their houses were part of a giant game that was about to change everything…

When Dreams Crumble

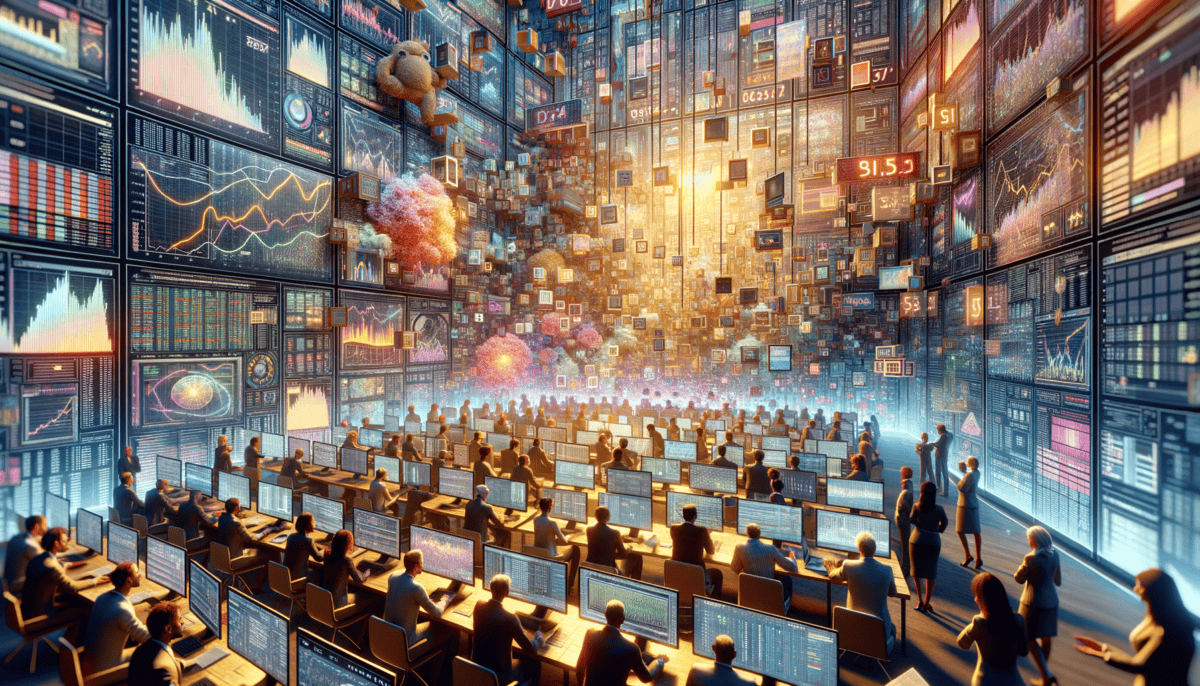

The year was 2007. Something big and scary was happening to houses all across America.

The First Signs

Jenny Thompson stared at her mailbox. Inside was another letter she didn’t want to open. Her house payment had gone up again!

Houses Nobody Wanted

“For Sale” signs started popping up everywhere. It looked like a forest of sad signs. But nobody was buying.

“I’ve never seen so many empty houses,” said Bill, the neighborhood mailman. “It’s like everyone just disappeared.”

The Domino Effect

When one house’s price went down, other houses nearby got cheaper too. It was like dominoes falling one after another!

Banks Get Scared

Tom, the bank worker, sat at his desk looking worried. His computer showed lots of red numbers. “Stop all new loans!” his boss shouted. “We’re in trouble!”

The Big Panic

One morning, everyone woke up to scary news. A big bank called Lehman Brothers had closed forever!

“If such a big bank can fail, what about the others?” people wondered. Everyone got scared and wanted their money back at the same time.

Jobs Start Disappearing

Maria lost her job at the construction company. “Nobody’s buying houses anymore,” her boss explained. “We have to close.” ♀️

Families Move Out

The saddest part was seeing families leave their homes. Jenny watched as her neighbors packed their things into trucks.

“Where will everyone go?” Jenny asked her mom.

“Some will move in with family. Others will rent apartments. But they’ll be okay. People are strong.”

Wall Street Worries

In New York, the big money people were very scared. The stock market went down fast!

“All those house loans we bought are worth nothing now,” said Mr. Chen from his office in China. “This is very bad.”

A World of Worry

The problems jumped from America to other countries like a giant game of tag. Banks everywhere had bought these bad house loans. Now everyone was in trouble!

As night fell over empty houses and worried families, everyone wondered: How did we let this happen? And more importantly – how do we fix it? The answers would change our world forever…

When Money Problems Spread Around the World

The trouble that started with houses in America was now causing problems everywhere!

Bad News Travels Fast

Sarah worked at a bank in London. She looked at her computer screen and gasped. “Oh no! Those American house loans we bought are worth nothing now!”

“It’s like a game of hot potato,” her boss said. “Everyone was passing these bad loans around, and now nobody wants to hold them.”

Banks Stop Trusting Each Other

Banks all over the world got scared. They stopped lending money to each other. It was like a giant game of freeze tag where everyone stopped moving at once!

Help From Governments

Leaders from different countries had emergency meetings. They knew they had to work together to fix this big problem.

“We need to help the banks,” said President Bush. “If we don’t, more people will lose their jobs and homes.”

The Big Bailout

The U.S. government decided to give banks lots of money – $700 billion! That’s more money than most people can even imagine!

Other Countries Join In

Countries like England, Germany, and China also helped their banks. They were all connected like a big family trying to help each other.

“We must work together,” said the leader of Germany. “When one country has problems, we all have problems.”

Hard Times for Everyone

Even with all this help, many people lost their jobs. Stores closed. Factories stopped making things. It was called the “Great Recession.”

In Greece, Maria couldn’t find work. In Japan, Mr. Tanaka’s factory had to close. In Brazil, Carlos’s coffee shop had fewer customers.

Making New Rules

World leaders knew they had to make new rules so this wouldn’t happen again. They were like parents making stricter bedtime rules after kids stayed up too late.

Learning Together

People from different countries learned an important lesson: we’re all connected. When one part of the world has money problems, everyone feels it.

“It’s like a big spider web,” explained Ms. Lee to her students in Singapore. “If one thread breaks, the whole web shakes.”

Signs of Hope

Slowly, things started getting better. Banks became stronger. People found new jobs. Houses started selling again.

“We learned from our mistakes,” said Sarah back in London. “Now we need to be smarter about money.”

As the world worked together to fix these big problems, everyone realized something important: money connects us all, and we need to be careful with it. The question now was: What other lessons did we need to learn to make sure this never happened again?

Learning from Our Mistakes

After the big money storm, people wanted to make sure it wouldn’t happen again.

New Rules for Banks

Tom, who worked at a bank in New York, looked at the new rulebook on his desk. Things were very different now!

“Now we have to check really carefully if someone can pay back their loan,” Tom explained. “No more easy money!”

Helping People Get Back Up

Remember Maria from the bank? She started teaching people about money. “It’s like learning to ride a bike,” she said. “You need to know how to balance!”

Building Better Communities

Communities came together to help each other. They were like a big team!

In Detroit, people turned empty lots where houses once stood into beautiful gardens. In Phoenix, neighbors helped fix up old houses for new families.

Watching for Warning Signs

Banks and governments now have special people who look for money problems before they get big. They’re like weather forecasters, but for money!

• Houses getting too expensive too fast

• Banks making too many risky loans

• People borrowing more money than they can pay back

A Stronger System

The money system is stronger now. Banks have to keep more savings, like having an extra umbrella for a rainy day! ☔

“We’re like a house that got knocked down by a storm,” said Mr. Chen, a bank manager. “But we built it back stronger!”

Looking to the Future

Young people learned important lessons too. Jenny, a high school student, started a money club. “We learn about saving and spending wisely,” she said proudly.

Making Better Choices

Sarah and her family finally got a new house. But this time, they made sure they could afford it. “We learned to live within our means,” she smiled.

Around the world, people understood that money problems in one place can affect everyone. We’re all connected, like stars in the night sky! ⭐

A Brighter Tomorrow

The story of the big money crisis taught us all something important: we need to be careful with money, help each other, and always plan for tomorrow.

“Sometimes the hardest lessons teach us the most,” Maria told her students. “Now we know how to build a better future together!”

Today, when you look around, you can see how we’ve grown stronger. Houses are homes again, not just investments. Banks are more careful. And people understand that working together makes us all safer and stronger. The big money storm showed us that when we learn from our mistakes and help each other, we can overcome anything!